The Big Idea: Asset managers occupy a uniquely influential position in commercial real estate (CRE). The role encompasses improving operations at scale, assessing and driving financial performance, and advancing firm strategy at the asset level. Too many spend their time as reporting analysts. Leveraging asset management software, which is made for these individuals, can directly improve returns, leverage, and culture.

A Day in the Life of an Asset Manager

Close your eyes for a minute and think about what your asset managers are doing right now. Not what they’re responsible for—we’ll touch on that later—but what tasks they’re completing right this second.

Our picture looks something like this:

- Frustrated calls with accountants and property managers on the hunt for accurate data

- Downloading, dragging, and dropping files from systems that look like MS-DOS

- Running cut, paste, and VLOOKUPs to aggregate data between PDFs and Excel spreadsheets

- Searching through email to find that one report answering that one question

- Fielding inbound requests from executives, property managers, leasing teams, and capital partners as the backlog of “ad hoc requests” grows larger and larger

The world around asset managers is evolving rapidly, yet their tools, systems, and workflow are decades behind the times. Why accept this as the norm?

What Makes Asset Management Such a Challenge?

Asset management, in the simplest terms, is responsible for two outcomes:

- Maximizing value

- Minimizing risk

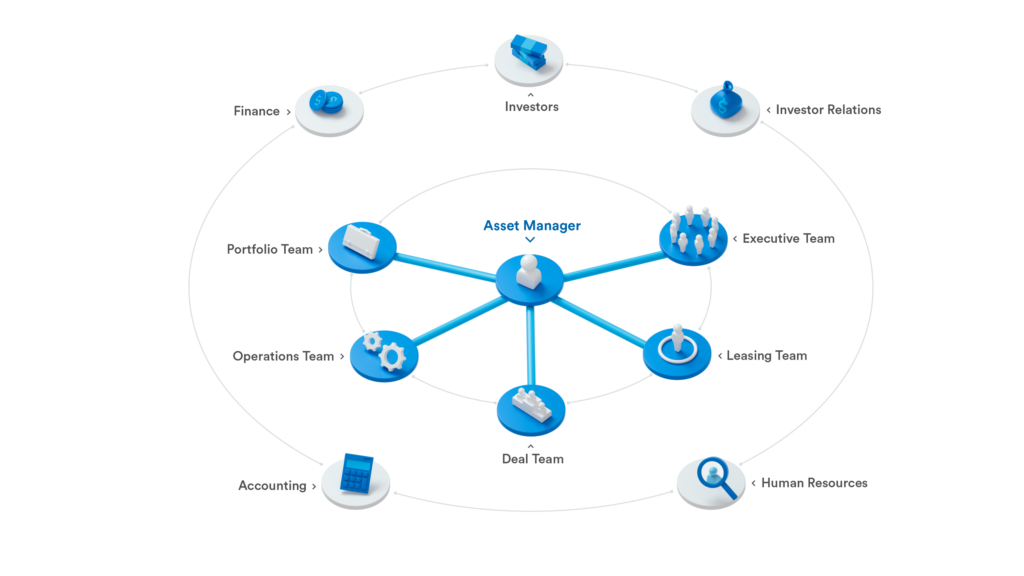

The role of asset managers is a hard one. Sometimes, it requires creating and ushering strategic change that creates portfolio-wide value. Other times, it’s about staying abreast of local and regional trends and maintaining competitiveness at the asset level. Always, it requires a heavy dose of stakeholder and people management.

It’s the most hybridized role in CRE, and it demands balancing the interests of executives and portfolio teams with the operations and leasing side of the business. And it needs help to modernize.

What is an Asset Management Platform?

First—software is here to stay. If you’re nodding your head, go on.

If you’re not convinced, we encourage you to start here. That’s an article from 2011 about the effect of software disruption on traditional industries—retail, agriculture, and defense. Nine years later, we’re still searching for a CRE asset management solution. Did we mention that CRE is the largest asset class in the world?

Second, let’s talk about data-driven culture. We promise it’s not a just buzzword. Today, asset management teams, at the crux of strategy, finance, and operations, are bombarded with requests. COVID-19 has brought an unparalleled level of scrutiny and urgency to dive deep into the numbers.

Asset managers have access to vast amounts of data, but most of that data is fragmented. They end up diving in and out of rent rolls, property details, loan documents, and systems designed for other functions (e.g., leasing agents and accountants).

Asset management software can help standardize your data by ingesting, aggregating, and structuring it for analysis. Plus, with a platform like WorkSpace that was designed specifically for the CRE industry, it can quickly uncover actionable insights with its industry-specific dashboards.

A well-designed technology solution can completely revolutionize the way the asset management function works.

However, it needs to be robust enough to support data and analytics. Here are some key features and impacts.

Features and Benefits of Asset Management Software

Single Source of Truth

The building blocks are essential. Asset management software will integrate with your primary systems to bring data together. With this, you’re able to:

- Establish one location where team members can share, access, and interact with data

- Eliminate the time required to share, forward, and hunt down figures and reports

- Facilitate self-service for junior and senior employees alike (save your accountant’s time!)

De-fragmenting your data opens the door for a new era of leverage—for your data and your teams.

We often hear asset management teams talk about the hours and hours they spend hunting, chasing, aggregating, and reporting data. That’s hundreds, often thousands, of hours a year they are spending away from their real jobs. We’re shaking our heads, too.

Pre-Configured Business Insights

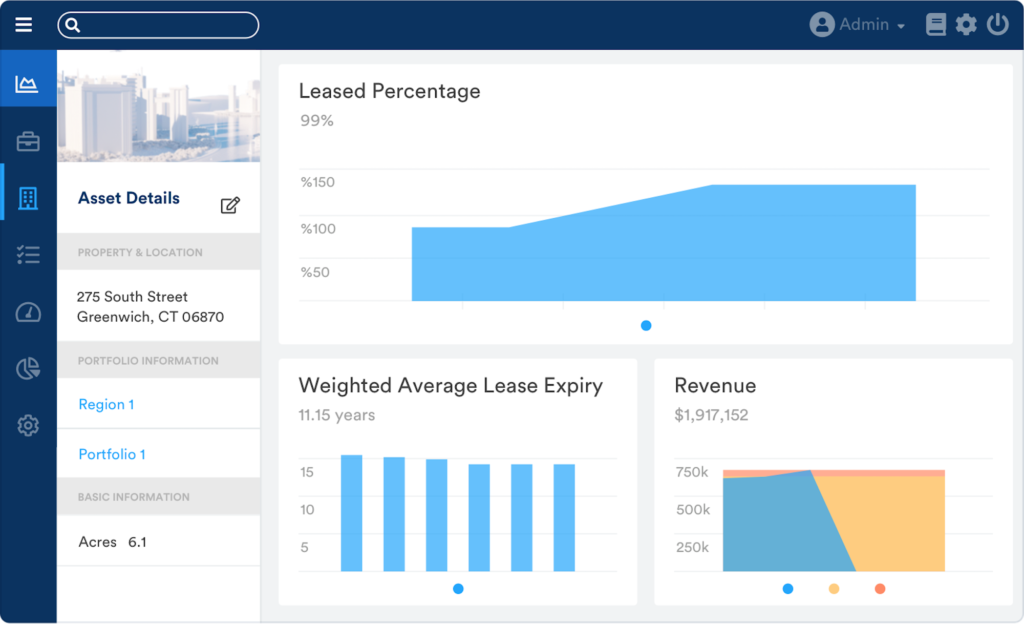

If connecting your data is the first step, liberating it comes next. An intuitive interface will guide your teams to interact with their data via dashboards and KPIs. By doing so, your team will build a common foundation to have higher-level conversations about performance and drivers.

Here’s an example of WorkSpace’s pre-configured dashboards and insights.

Full Resolution Data

Financials, rent rolls, leasing, loans … this data tells a story about an asset. A robust, granular asset management tool facilitates the connection between the asset manager and their portfolio. Consider the ability to, in two clicks, understand the GL-level drivers behind variance to budget. In equal time, aggregate the entire fund to see KPIs and aggregated metrics—without Excel. Now imagine that ability scaled across your entire organization.

Research shows that two out of three firms have missed lease escalations in the last six months. Technology can eliminate this risk.

Web-Hosted and Cloud-Based

Modern solutions are off-premise because they protect customers from the cumbersome parts of technology management. No servers, no storage, instant software updates … these are table stakes for the modern set of CRE technology solutions. Web tools also allow for access from any device—mobile, tablet, or laptop—and escalate collaboration and access go to the next level.

Third—consider the effects on your people. Think back to the picture we described at the start of this piece. Our people often feel simultaneously burned out and underutilized. Real estate professionals came into the industry to assess trends, think strategically about improving asset value, drive tangible impact, and artfully combine human intuition with data. Is your organization following through?

A holistic asset management solution can also fundamentally change the way you leverage human capital.

- Leverage. Hours previously spent on “data pushing” will evaporate, and you’ll drive down employee turnover and burnout.

- Objectivity. Assessing high and low performers will simply become a digital review of their activity, curiosity, creativity, and impact.

- Centralize. You’ll reduce operational risk, as information will no longer be siloed, and essential pieces of data won’t be, “somewhere on Ron’s desktop” (that’s a real quote).

- Ramp. New hire training and onboarding will become less a question of mastering antiquated software and reporting formats and more about learning how your firm’s strategy is deployed, assessed, and managed.

Winners in many other industries have built a reputation for being a place talent can thrive and grow. You’ll find it challenging to identify a firm that’s earned such a reputation without investing in the tools and technology to support its people.

Begin Exploring Asset Management Software Now

We know that’s a lot to absorb. Here are some tips we can share to help you crack the code.

- Educate yourself. Learn what technology your firm uses and why. Talk to your colleagues about their Asset Management challenges and how they’ve solved them.

- Invest a few hours. Think about how much research you do when buying a new car or that fancy new exercise bike. Now think about how much more time you spend at work than driving or working out. It’s worth a few half-hour conversations with vendors to learn what’s out there … it’s probably part of your job. We have transparent, no-pressure conversations with the industry all the time – about the state of CRE, their needs and pain points, our product and roadmap. If you want to chat, take us up on it, or feel free to learn a little more here.

- Be honest. We often see well-intentioned teams get seduced by the idea of “fully customized” solutions and charge down the “build” path. Sometimes, that’s the right path. Often, it means a few years of toiling without much to show. Ask yourself: Does your company have a track record of building software solutions in-house? Do you have the technical teams, talent, budget, and stamina to see it through? Is that extra 10% of customization worth it?

- Lead, don’t follow. The current pandemic and market volatility are the perfect conditions to create winners and losers. Be confident that you’ve kicked the tires enough to be on the right side when the dust settles.