Though I am currently a WorkSpace employee, it wasn’t that long ago I was a property manager. And if you read no other part of this post, here’s the bottom line: WorkSpace’s asset management platform produces your financial report in a live, intuitive format, making your monthly financial reporting a breeze. If you’re anything like me, you’ll take one look at the asset management app and wonder where it’s been all your life.

Have you been blindsided by an AR question mid-month? Or spent the better part of the week preparing month-end financial reports for your portfolio? How about putting your budget binder away only to pull it back out again 3 minutes later to look up another month? That’s where asset management gives property managers a big advantage.

But first, a quick review of what asset management software is.

What Is Asset Management Software

Commercial real estate is the largest asset class in the world and asset management teams, at the crux of strategy, finance, and operations, are bombarded with requests. Asset managers have access to vast amounts of data, but most of that data is fragmented. Technology can bring that data together, with relative ease.

Asset management software can help standardize your data by ingesting, aggregating, and structuring it for analysis.

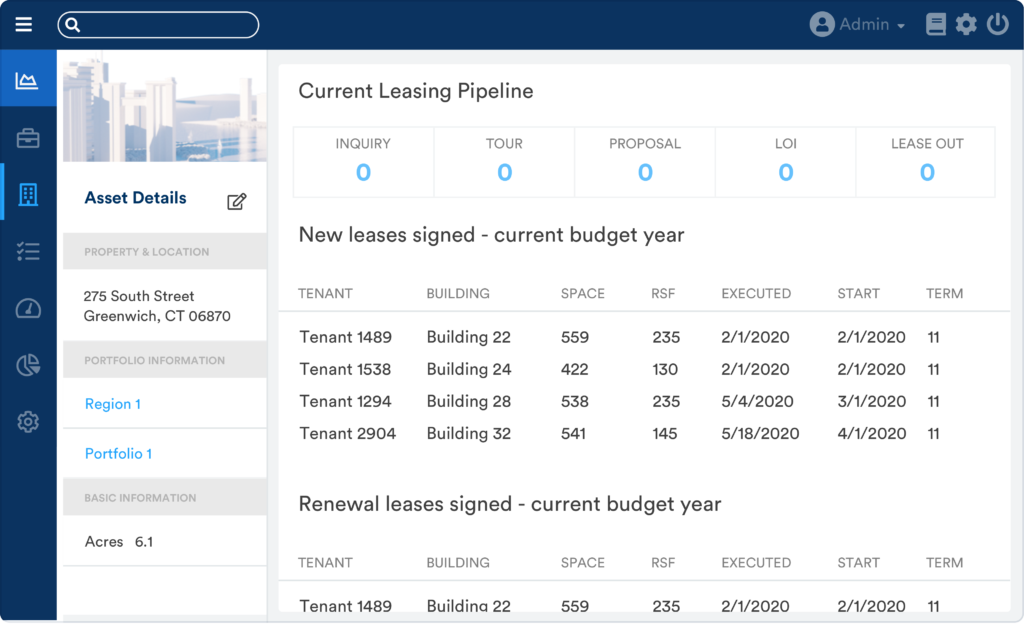

Plus, with a platform like WorkSpace that was designed specifically for the CRE industry, it can quickly uncover actionable insights with its industry-specific dashboards.

If you’re interested, here’s a deeper dive into asset management software and its key features and impacts.

Why Asset Management Software Is a Must for Property Managers

As a property manager, I had a helpful staff that chased down rent payments, processed invoices, monitored service requests, and took on most of the day-to-day tasks, but I was still responsible for the overall health of the properties. The only time I could get a reasonable handle on the KPIs was when I was producing the monthly financial reports. I’d receive a 70+ pages PDF per property, with a fair amount of redundancy, to cobble together a report that included A/R, leasing details, budget variances and a narrative.

We all know how important property management software is to the daily operations of our portfolio, but what about the facts and figures that concern asset managers and building owners the most? None of the traditional property management software I’ve used can answer a mid-month accounts receivable (AR) question or shorten the time I spend gathering data for my month-end financial reports, or show me my budget and actuals on the same page. Sure, accounting software can do that, but how many building owners or asset managers want to (or can) navigate through the accounting software?

Our asset management solution collects your most significant financial information from your accounting universe and presents it in real time as your accountants close the month.

Do you manage portfolios with multiple owners and a range of accounting systems? No problem, that’s why we built asset management! We harness data from all sorts of systems to populate the KPI dashboard. And what executive doesn’t want access to more KPIs?

There’s no hunting. From property coordinators to leasing directors to principals of real estate investment firms — they can all see your property’s rent roll, current and historical AR, the leasing pipeline and budget line items. Everyone is on the same page, literally.

Here are four more reasons why our asset management tool is a must-have software for property managers.

1. Asset Management Software Provides 24/7 Accounts Receivable Visibility

Has this happened to you? You’ve received most of your rent payments for the current month and next month’s statements have yet to go out, but your asset manager calls to ask about Tenant XYZ’s status. When it would happen to me, I’d start by looking through my emails to see if I’d received anything recent from the tenant, then I’d log into the accounting software and then quickly ping my accountant to confirm there wasn’t a stray check floating around.

With asset management’s AR tab pulling data directly from the accounting software, you can see that updated balance as soon as the check is entered in by your accountant.

You can see when the last payment was made, any open charges, any prepayments, and what is overdue. All your tenant’s details are on one page, no more clicking through each tenant for updates or running daily reports.

This still might not prevent you from hunting for that stray check, but it does eliminate another pain point of mine…

2. It Means You’re No Longer Beholden to Accounting Software

Let’s face it, the only people who LIKE accounting software are accountants; and that’s assuming it’s a relatively new version. For the rest of us, accounting software feels clunky and counterintuitive, but is still a crucial tool for those comprehensive financial views.

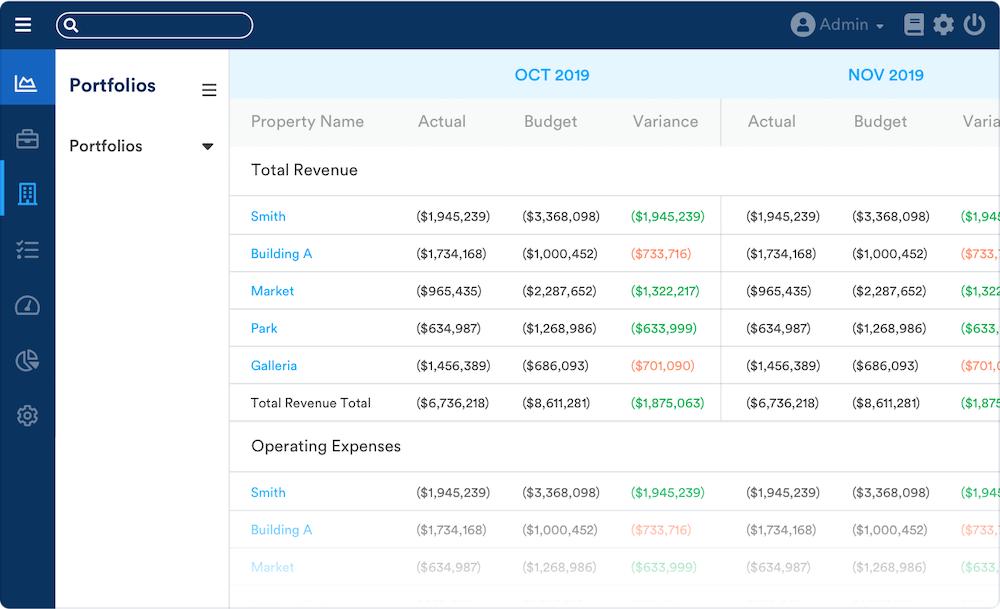

In addition to AR, WorkSpace’s asset management software would also have provided me with instant, clean views into the NOI, debt service, capital expenses, and cash flow on one page.

No more running CSV reports or clicking around multiple platforms to pull the most frequently needed data. And while I didn’t need to have the NOI memorized, sometimes it feels like my boss did, which is why I love the fact that we’re looking at the same data at the same time. Which leads perfectly into my next point.

3. You Can Get Historical and Current Budget Variances in One Click

In my office, there was a hutch behind my desk that was chock-full of 4-inch binders. In a world where you can purchase a home entirely online, I was still printing and filing annual budgets and monthly variance reports. By the end of the year they were stained, dog-eared and torn.

Every day I was digging through those binders multiple times. Did we have these reports and budgets digitally? Of course, but accessing the shared drive, then clicking through the accounting folder and opening the file sometimes felt more laborious than opening a huge binder. Plus, there was always a fear that I’d lean on the keyboard and change some budget number that wouldn’t get noticed until it really counted.

If I had WorkSpace, asset management could be open all the time (no emails asking me to close the spreadsheet so someone else can edit) in a read-only, online version, ready to view. As soon as accounting closes the monthly financials in their accounting system, the updates flow through to WorkSpace, eliminating that knowledge lag between accounting and property management. An on-demand glimpse into your actuals as soon as they’re ready, what could top that? But wait, there’s more!

An on-demand glimpse into your actuals as soon as they’re ready, what could top that? But wait, there’s more!

4. It Reduces Report Production Time

In a perfect world, no one would have to draft reports because the data would just live where everyone can access it anytime, anywhere. But some people just love to get a packaged report, and honestly, I do get some satisfaction producing something to the higher-ups showcasing my work.

Having a reporting function is not groundbreaking, but WorkSpace provides a reporting function that pulls leasing details, AR, the rent roll, balance sheet, income statement, and more with one click. It also includes cohesive formatting and a cover page!

But I think my favorite part of the asset management reporting function is the ability to add my narrative comments right in the platform. Once the month has been closed, I can click on the Summaries tab, type in my notes on outstanding issues, MTD and YTD overviews and even lender compliance. I can then export the entire report and save it in the Documents tab or email the pdf to the appropriate parties.

Asset Management Isn’t Just for Asset Managers

It’s a poorly kept secret that the property management industry can be slow to adopt new technology. Between the daily operations, managing the budget, boosting value to the building and mitigating risk we forget to revisit our processes for an efficiency check-up. If you’re frustrated that your workflow is causing you to spend more time paper-pushing and less time engaging with your tenants or enhancing your building, it’s time for a change.