The global economy is reeling. That’s no surprise to anyone.

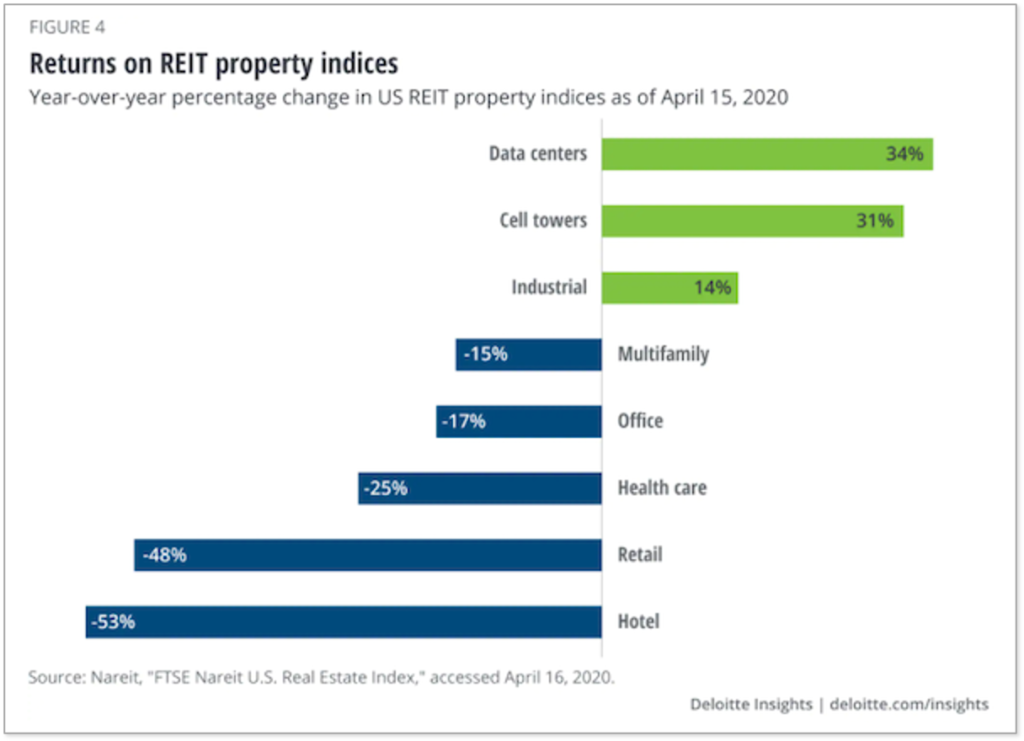

Our industry, at the center of civilization and commerce, has taken its lumps, with volatile performance across major asset classes.

In the early days of the crisis, industry analysts and advisors attempted to predict the return to normal. Doing so has become an impossible task; now, we are turning to prior crises to learn how, not when, winners emerge from chaos.

A recent Deloitte report, The Heart of Resilient Leadership: Responding to COVID-19, describes the three stages of a macroeconomic crisis: respond, when firms deal with the present situation and manage continuity; recover, when firms learn and employ strategies to emerge stronger; and thrive, when firms prepare for and shape the “next normal.”

One of the keys for transitioning from the “recover” phase – where we are now – to the “thrive” phase is adopting and embracing new solutions to drive efficiency and address long-standing capability gaps. This is where creativity and solutions-oriented firms can win.

The Covid-19 Effect on the Adoption of PropTech

Covid-19 has changed the way we work. This, in turn, has shed light on areas that needed attention and which can no longer be ignored. The show must go on, but it has to look a little different.

Remote Work

Much of the professional world is working remotely, and that shift is expected to have long-term impacts when “normal” resumes. In an industry that relies on attentiveness, hands-on management, and strategic execution to drive returns for investors, the absence of face-to-face meetings and ad hoc office time to discuss the latest performance numbers is a massive risk for any organization.

The need for technology that connects teams and ensures that everyone is working with the same data has never been more critical.

Demand for Data Visualization

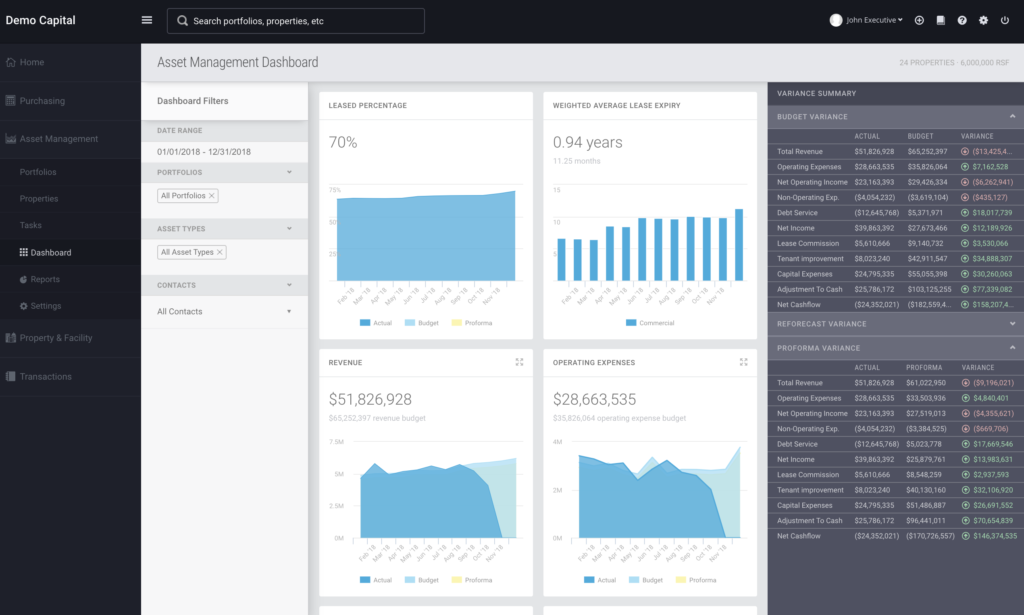

Investors, operators, and brokers need real-time information. Taking hours to manually pull reports, collate information into spreadsheets, analyze the data, and share it in your upcoming (now non-existent) meeting won’t fly anymore. Analysts will need real-time data and dashboards to draw the conclusions that had previously been made during highly collaborative settings. Even more, these dashboards will need to be easily shareable and consumable by everyone within the organization.

No Wiggle Room to Make Bad Decisions

Finally, all investors and fiduciaries fear the unknown unknowns. Imagine the financial implications of a cost overrun on a lobby renovation project, one that is over budget and off track for months on end. Or, consider exposure in your tenant base from outstanding receivables and the remediation efforts required in a remote world. What about relative performance on lease pipelines between regions and assets?

The historical model of canned reports and pre-configured analyses crowd out our ability to leverage human curiosity, intuition, and critical thinking across a portfolio.

The combination of a comprehensive financial and operational system with an analytical mind can prevent unknown unknowns, escalate material exposure, and drive performance results, even in a down cycle.

What is an Asset and Portfolio Operating Platform?

Simply stated, an asset and portfolio operating platform is a software service designed to uncover financial health and operational insights that deliver investor returns. Feel free to learn more here.

Investors, owners, and managers want (and need) to get their arms around the financial and operational health of their assets and portfolios. Without a centralized view, they end up settling for fragmented reports pulled together with data from all sorts of systems and data sources. Most of the time, this takes weeks, or even months, to assemble, and by the time it gets into the hands of a decision-maker, it’s already outdated. This hampers the ability to make decisions and, ultimately, drive profit.

An asset and portfolio operating platform like WorkSpace automates the process of consolidating, cleaning, and visualizing data, ultimately benchmarking against standard real estate performance metrics. In doing so, it surfaces holistic financial and operational insights never before uncovered through single-system reporting and analysis — it was born and built for the commercial real estate industry.

While some CRE investment firms have looked to internal BI solutions to fill this gap, they’re difficult and costly to design, implement, and scale. Once launched, they require ongoing attention from solution architects or certified systems administrators, and they aren’t easily used by everyone in the organization. Adoption is low, and ROI is abysmal.

Top 5 Roles that Benefit from an Asset and Portfolio Operating Platform

While point solutions have their place, they usually address one business problem and serve one group within an organization (think QuickBooks for Accounting). Asset and portfolio operating platforms serve multiple roles throughout an organization. Here’s how.

#1: Asset Managers

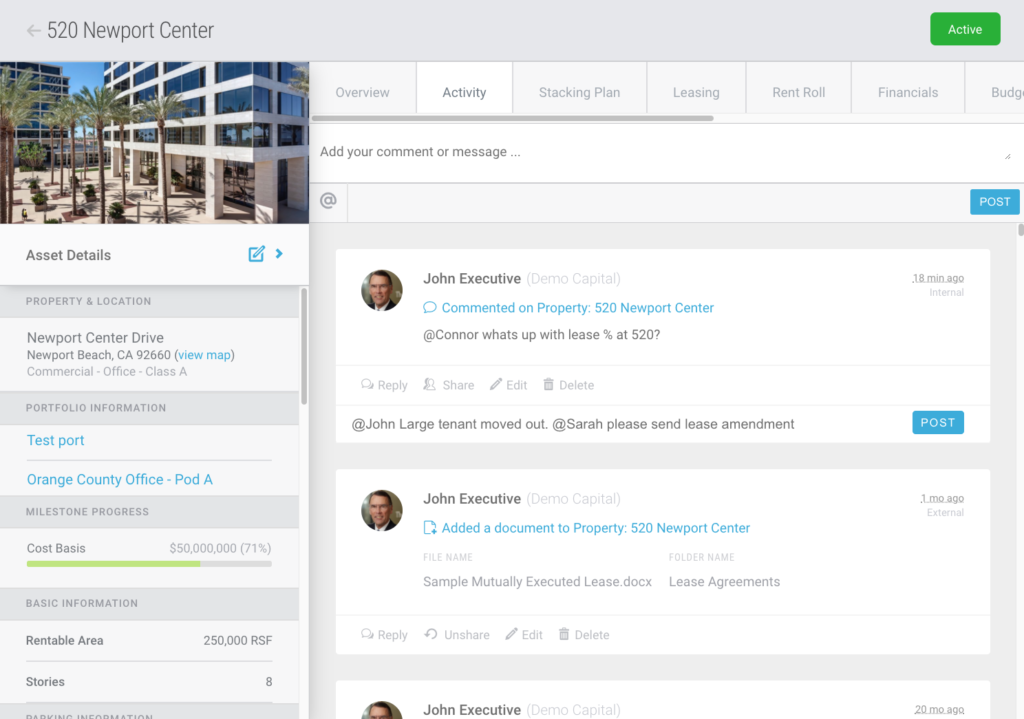

Creating portfolio-wide value while minimizing risk is a heavy lift. Asset managers must monitor rent rolls, property details, and loan documents, all while dealing with leasing agents and accountants. Imagine if they had one place where all their data lived and everyone they worked with had access to that same data in real time.

This could eliminate countless hours spent hunting down information, or people, and then trying to report on that data. Imagine if the reports and dashboard were already configured so asset managers could spend less time gathering numbers and more time gleaning insights, allowing them to intervene earlier and deliver greater investor returns. That’s exactly what an asset and portfolio operating platform does.

#2: Property Managers

Tenant management has never been more critical than it is now, as we see commercial rents dropping in major cities across the US.

The property management module of our asset and portfolio operating platform will help the PM team increase efficiency in tracking and completing work orders, automating and reporting on all maintenance tasks in a specific property or portfolio, and trigger a shift from a reactive to proactive and preventative management model.

Plus, property managers have the ability to engage with tenants to access and receive information quickly, keeping tenants happy and occupancy high.

#3: Investors and LPs

The modern investor demands transparency beyond one-off quarterly reports. With record-breaking fundraising over the last several years, the issue isn’t one of capital availability, it’s one of investor confidence. Increasingly, we expect to see firms that can prove their unique capabilities, competitive advantages, and operating results being rewarded. Strategies without evidence are unlikely to remain compelling.

We’ve worked with one large property management firm that actively pitched its tech stack as a competitive advantage to win projects. Their proximity to their assets and ability to monitor and drive performance was not a bullet in an investor deck; it became a tangible strategy for differentiation.

Demystifying “performance” by sharing detailed trends analyses; combining budget, actual, and forecasting intelligence; and instilling confidence in your efficient operations is a license to invest with confidence and reward high performers in the future.

#4: Executive Teams

There are a million things to do, and counting. We get that. What we don’t get is why we see so many C-team executives asking questions about data quality, factchecking, and hunting through email to find that one report from months ago.

The next generation of commercial real estate promotes self-service.

Instead of hunting down numbers, an asset and portfolio management system provides all the basic data and analyses, so executives can ask strategic questions. Instead of reconciling a finance report with an asset management report, they know that everyone is using the same data.

When you consume the most important financial and operational metrics from one centralized place, you don’t need to jump into any new systems or spreadsheets again.

#5: Finance and Accounting

The liberation of data has tremendous, organization-wide effects. Most finance and accounting teams are overwhelmed. Instead of maximizing their leverage and improving the operating capacity of the firm, we often see these teams operating as data management and reporting functions for the entire organization. The whiplash effect of one ad hoc email request can eat up hours in a day. Often, this means teams bring on more bodies to throw at the problem, rather than deploying a solution to enable scale.

With a centralized data platform, finance and accounting professionals can spend their time driving value that requires their unique, specialized skillset. They become advisors to the business, offer proactive commentary on trends, risk, and exposure, and are several times more efficient.

Bonus: CIOs and the IT Team

One of the best things about an asset and portfolio operating platform is its ability to simplify data consolidation. WorkSpace, for example, ingests data from tons of point solutions, including Yardi, MRI, and VTS, and automates insights in its industry-specific preconfigured dashboards. This takes the heavy data management lift from your IT team and saves you a boatload you’d otherwise spend on a data warehouse with an in-house solution.

Explore an Asset and Portfolio Operating Platform Today

Point solutions have brought the industry a long way on the technology curve, but things like assisted workflows, better data, and process automation are still missing — and they are needed now more than ever. Don’t take my word for it, industry experts believe that CRE firms that don’t incorporate tech innovations now won’t be successful in the future.

My advice: If you’re behind the curve on this one, start exploring it today. We’d be happy to give you a demo of WorkSpace.